child care tax credit portal

Families eligible for the expanded Child Tax Credit CTC dont have to wait until they file their taxes in 2022 to start getting payments. The Child Tax Credit CTC is a federal credit that helps families afford the everyday expenses of raising a child.

Didn T Get Your Child Tax Credit Here S How To Track It Down Gobankingrates

Head to the IRS Taxpayer Assistance Tool page and enter your ZIP code.

. This year Americans were only required to file taxes if they. By filing federal income taxes with the Internal Revenue Services IRS Pennsylvania. At first glance the steps to request a payment trace can look daunting.

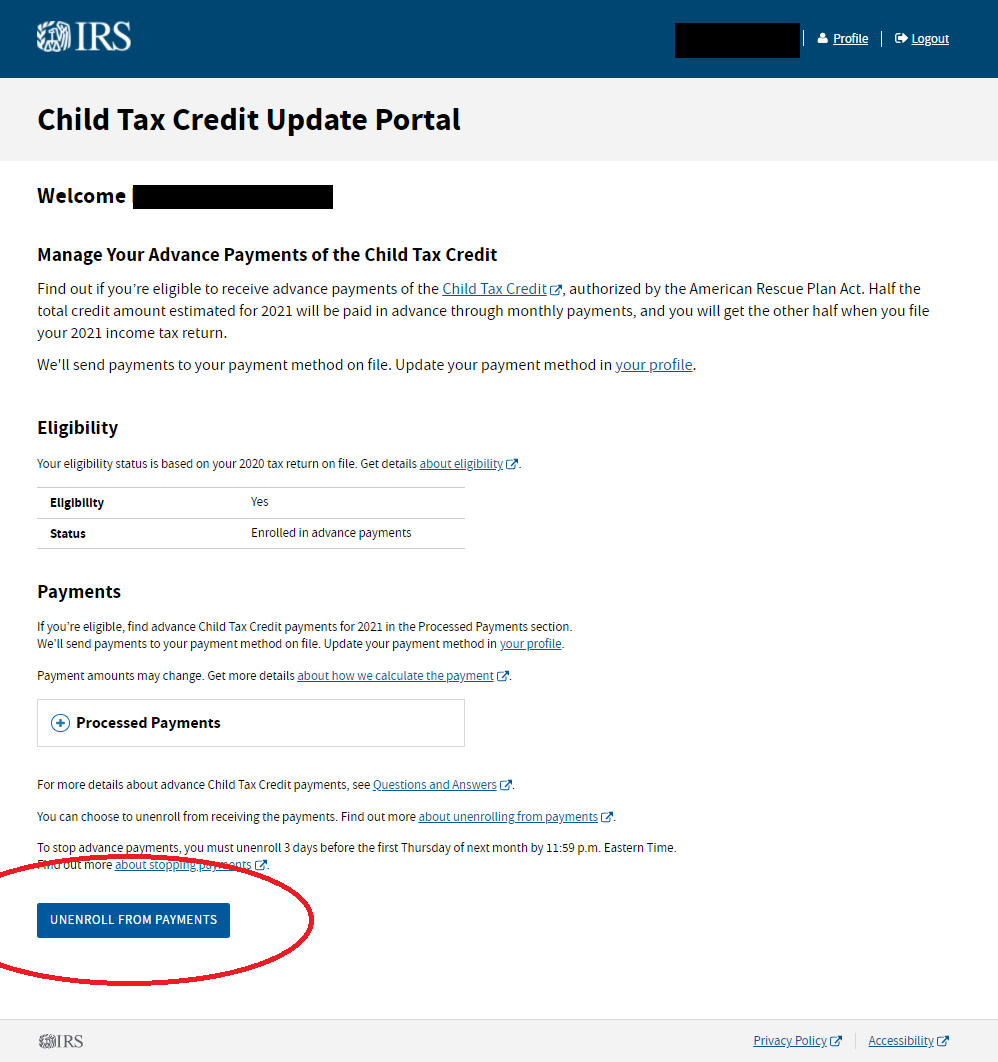

If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim. The credit amount was increased for 2021. The Child Tax Credit Update Portal lets you opt out of receiving this years monthly child tax credit payments.

The Families First Coronavirus Response Leave Act FFCRA can help most. Parents and relative caregivers can get up to 3600. The IRS issued three Economic Impact Payments during the coronavirus pandemic for people who were eligible.

The American Rescue Plan increased the Child Tax Credit from 2000 per child to 3000 per child for children over the age of six and from 2000 to 3600 for children under the age of. Heres how to schedule a meeting. Increasing the maximum credit that households can claim to 3600 per child age 5 or younger and 3000 per child ages 6 to 17.

1200 in April 2020. SEE MORE Child Care Credit Expanded for 2021 Up to 8000 Available. You may be eligible for Child Tax Credit payments even if you have not filed taxes recently.

If you got advance payments of the CTC. If you received any monthly Advance Child Tax Credit payments in 2021 you need to file. The American Rescue Plan increased the amount of the Child Tax Credit from 2000 to 3600 for qualifying children under age 6 and 3000 for.

A childs age determines the amount. Distributing families eligible credit through monthly checks. Not everyone is required to file taxes.

The United States federal child tax credit CTC is a partially-refundable tax credit for parents with dependent childrenIt provides 2000 in tax relief per qualifying child with up to 1400 of that. For 2021 eligible parents or guardians. Later this summer and fall the IRS will add more features to the Child Tax Credit Update Portal.

The Child Tax Credit for tax year 2021 is up to 3600 per child under 6 and 3000 per child age 6-17. A childs age helps determine the amount of Child Tax Credit that eligible parents or guardians can receive. 600 in December 2020January 2021.

To help families during the COVID-19 pandemic the US. Youll need to print and mail the completed Form 3911 from. When you claim this credit when filing a tax return you can lower the taxes you owe.

Check mailed to a foreign address. The Employee Retention Tax Credit ERTC is a great opportunity for child care businesses with W-2 employees. Dear Connecticut Resident Thanks to a new federal law the American Rescue Plan most families in Connecticut with children under 18 are now eligible to receive Child Tax Credit.

The federal Child and Dependent Care Credit helps families pay for child care for children under age 13 or for care of dependent adults. The American Rescue Plan Act ARPA of 2021 expands the Child Tax Credit CTC for tax year 2021 only. The American Rescue Plan enacted in last March increased the tax break to 3000 from 2000 per child under age 17 with 600 more for kids under age 6.

Choose the location nearest to you and select. The Child Tax Credit CTC provides financial support to families to help raise their children. Thanks to the American Rescue Plan the vast majority of families will receive 3000 per child ages 6-17 years old and 3600 per child under 6 as a result of the increased.

This means that instead of receiving monthly payments of say.

Childctc The Child Tax Credit The White House

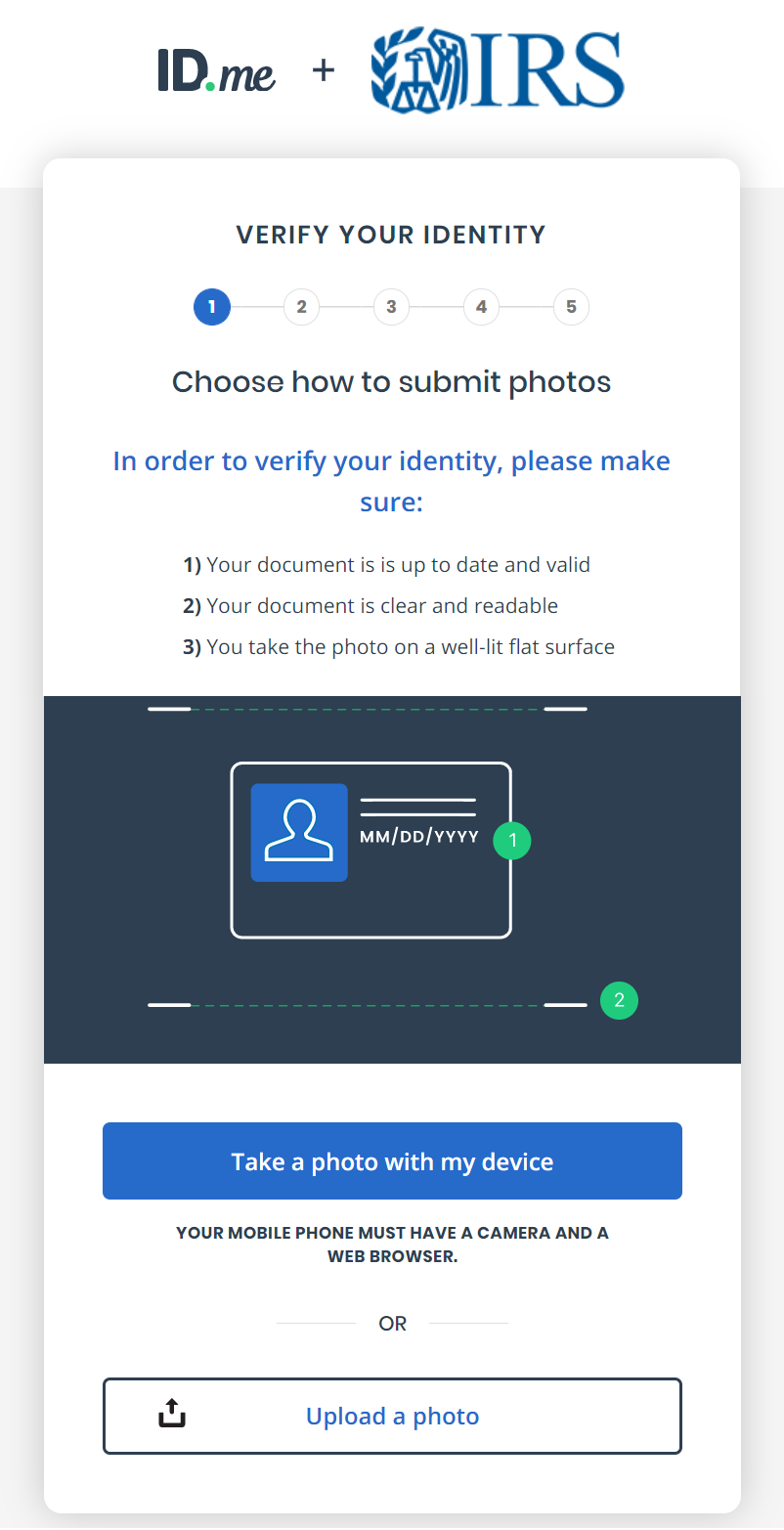

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

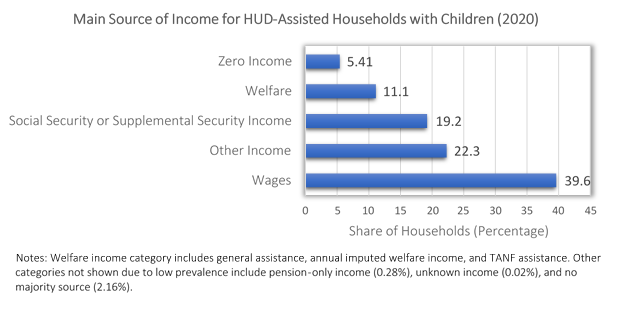

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Help Is Here The Expanded Child Tax Credit Congressman Emanuel Cleaver

Parents Guide To The Child Tax Credit Nextadvisor With Time

The Advance Child Tax Credit An Opportunity For Hud Assisted Families With Children Hud User

Five Facts About The New Advance Child Tax Credit

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

What Families Need To Know About The Ctc In 2022 Clasp

2021 Child Tax Credit What It Is How Much Who Qualifies Ally

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

White House Unveils Updated Child Tax Credit Portal For Eligible Families

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Tax Tip 2021 Advance Child Tax Credit Information For U S Territory Residents Tas

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back